Homeownership Builds Wealth and Offers Stability

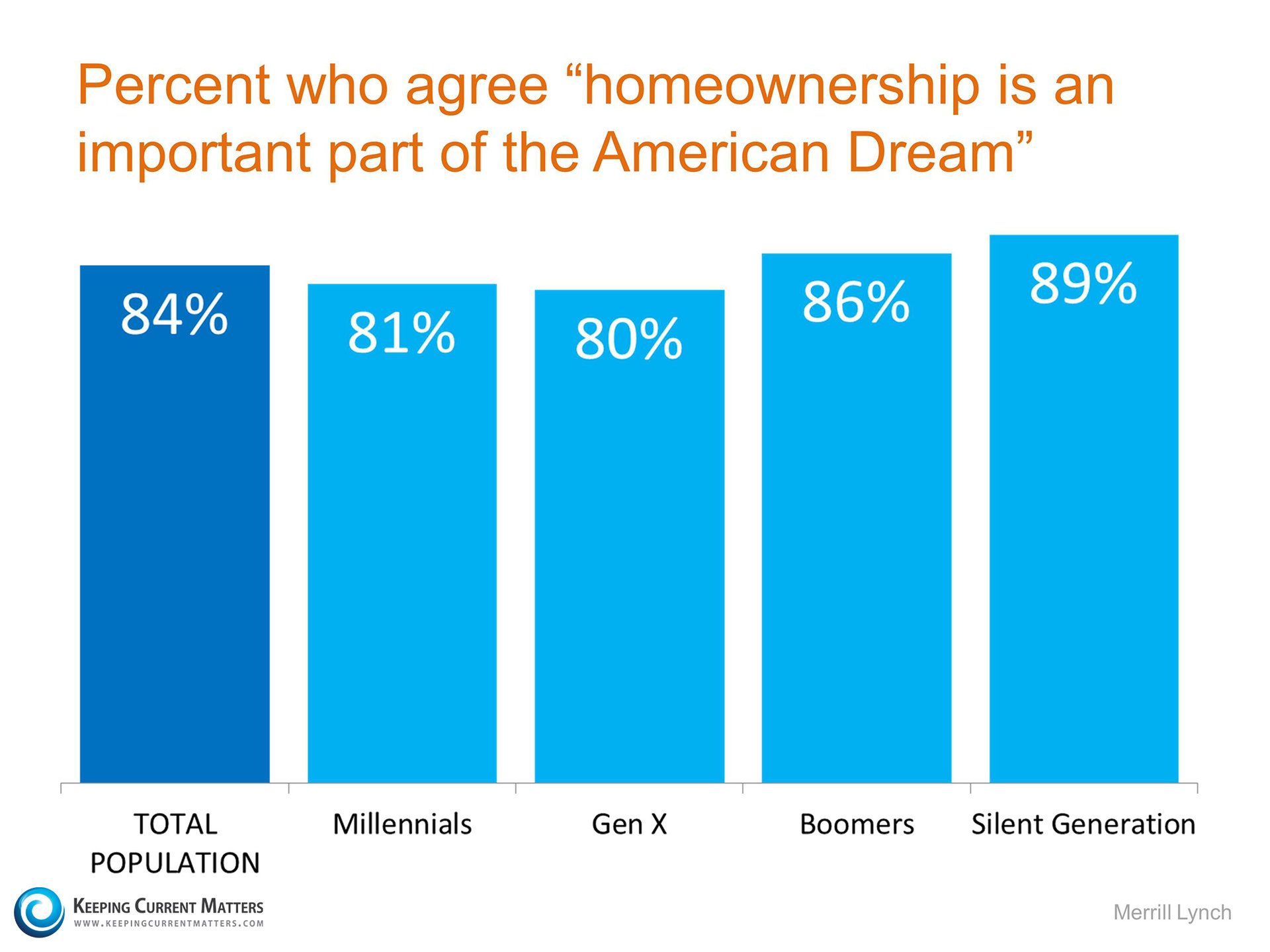

The most recent Housing Pulse Survey released by the National Association of Realtors revealed that the two major reasons Americans prefer owning their own home instead of renting are:

A survey of property managers conducted by rent.com last month disclosed two reasons tenants should feel less stable with their housing situation:

SOURCE: the smart guys at KCM.com

- They want the opportunity to build equity.

- They want a stable and safe environment.

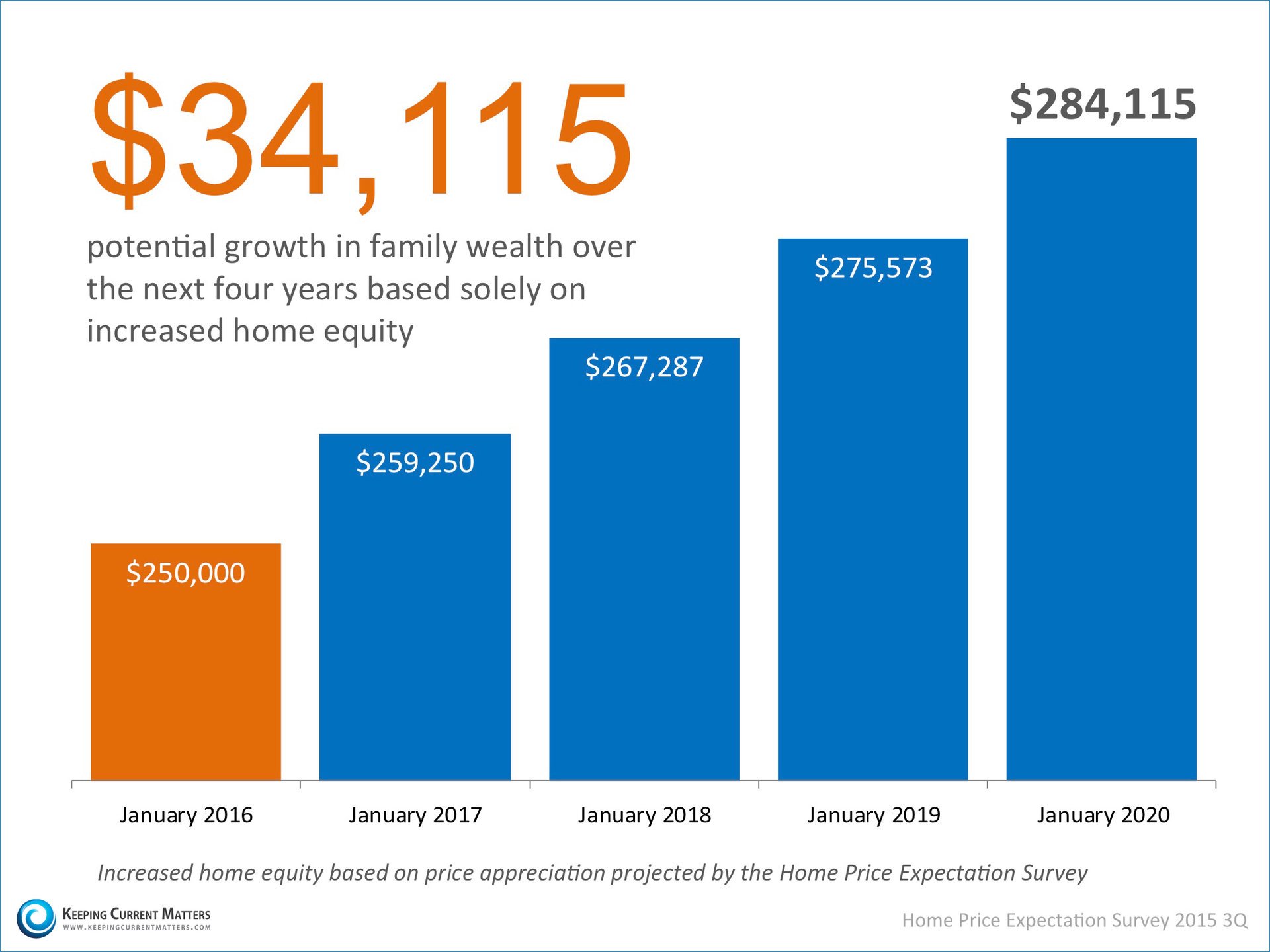

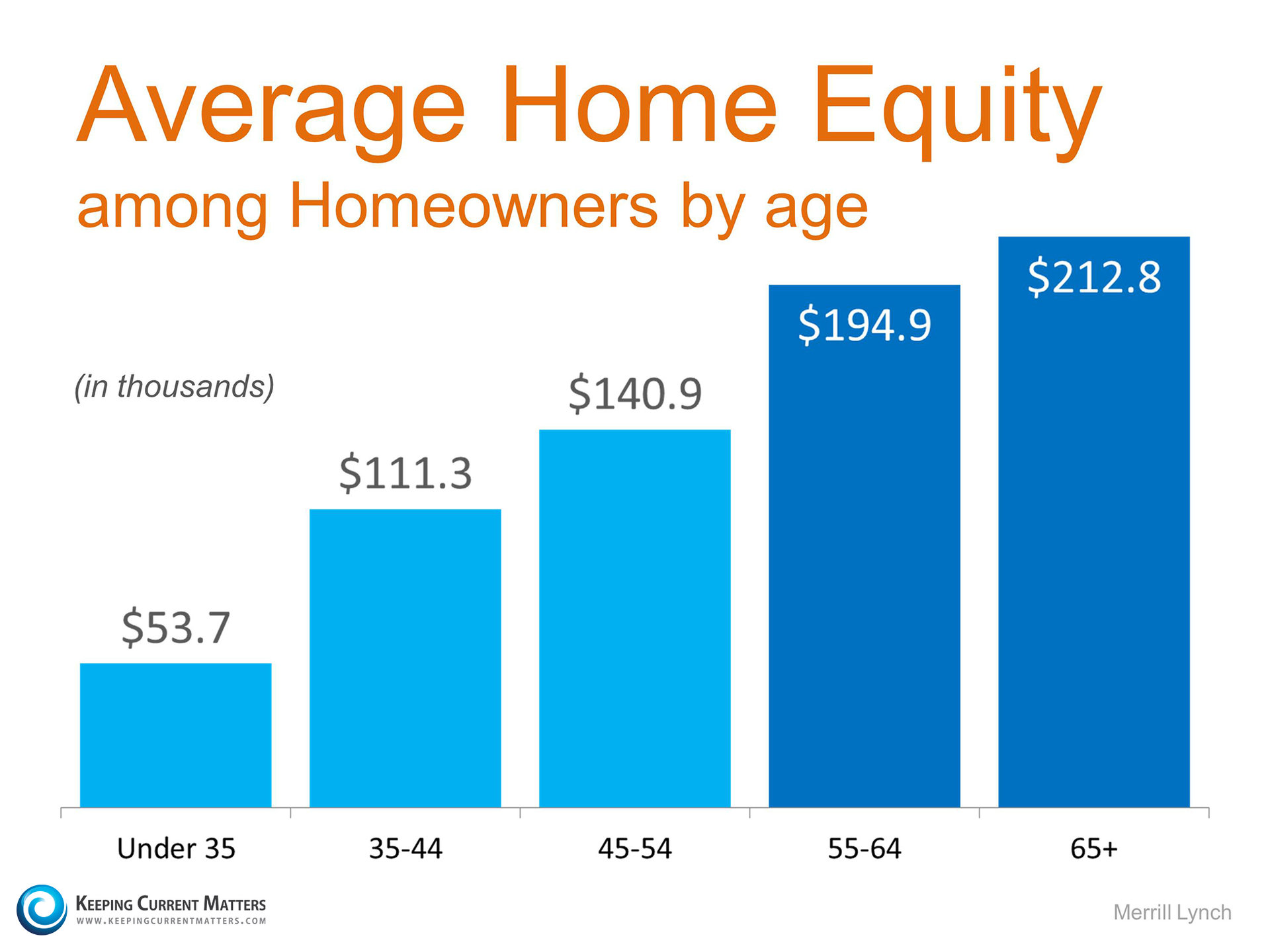

Building Equity

In a recent article, John Taylor, CEO of the National Community Reinvestment Coalition, explained that those who lack the opportunity to become homeowners have a weakened ability to reinvest their wealth:“We traditionally have been huge supporters of homeownership. We see it as a way to provide stability for households but also as an asset-building strategy. If you continue to be a renter, locked out of the homeownership arena, increasingly those things are further and further out of reach. They’re joined at the hip. They perpetuate each other.”

Family Stability

Does owning your home really create a more stable environment for your family?A survey of property managers conducted by rent.com last month disclosed two reasons tenants should feel less stable with their housing situation:

- 68% of property managers predict that rental rates will continue to rise in the next year by an average of 8%.

- 53% of property managers said that they were more likely to bring in a new tenant at a higher rate than negotiate and renew a lease with a current tenant they already know.

Bottom Line

Homeowners enjoy a more stable environment and at the same time are given the opportunity to build their family’s net worth.SOURCE: the smart guys at KCM.com

![The Difference an Hour Can Make [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/10/The-Difference-a-Hour-Makes.jpg)

![Where Will Home Prices Be Next Year? [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/10/Home-Prices.jpg)