14,986 Homes

Sold Yesterday… Did Yours?

|

| 14,986 Homes Sold

Yesterday… Did Yours?

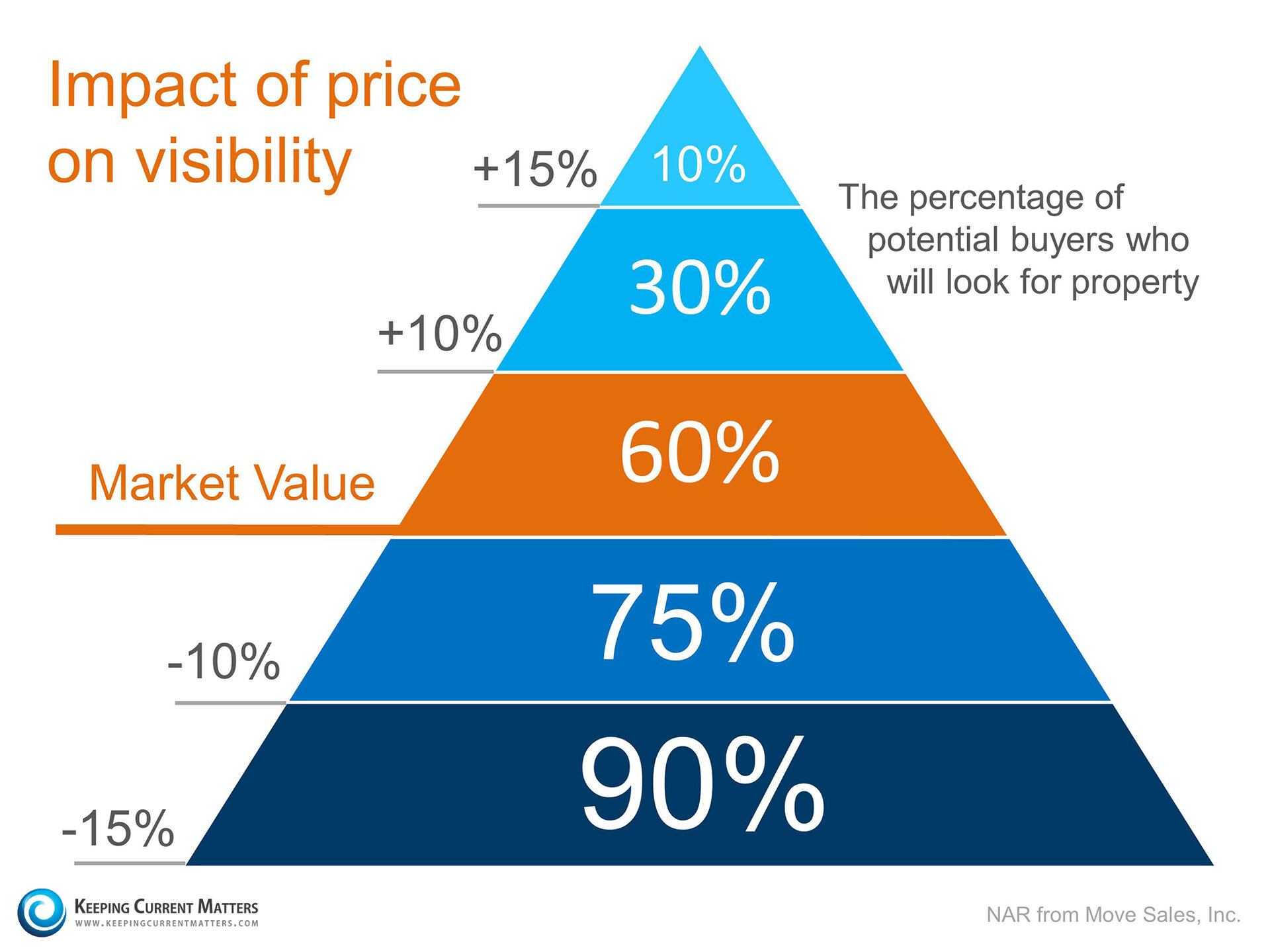

There are some homeowners that have been

waiting for months to get a price they hoped for when they originally listed

their house for sale. The only thing they might want to consider is... If it

hasn't sold yet, maybe it's not priced properly.

After all 14,986

houses sold yesterday, 14,986 will sell today and 14,986 will sell tomorrow.

14,986!

That is the average number of homes that sell each and every

day in this country according to the National Association of Realtors’

(NAR) latest Existing Home

Sales Report. NAR reported that sales are at an annual

rate of 5.59 million. Divide that number by 365 (days in a year) and we can see

that, on average, over 14,986 homes sell every day. The report from NAR also

revealed that there is currently only a 4.0-month supply of inventory

available for sale, (6-months inventory is considered ‘historically

normal’). This means that there are not enough homes available for sale

to satisfy the buyers who are out in the market now in record numbers.

Bottom Line

We realize that you want to get the fair market value for your

home. However, if it hasn't sold in today's active real estate market, perhaps

you should reconsider your current asking price.

SOURCE: those smart guys at KCM.COM

|

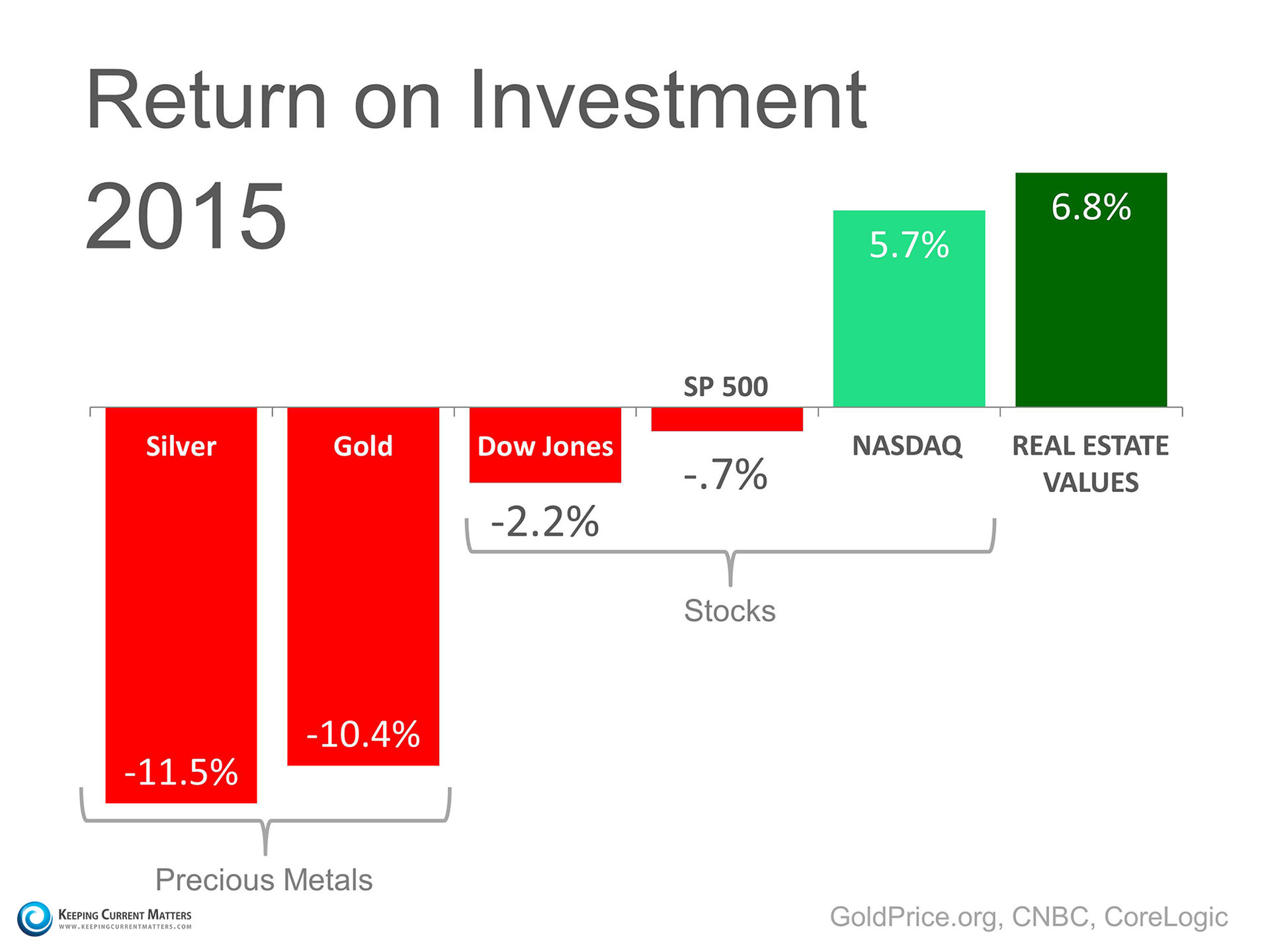

Every homeowner wants to make sure they

maximize their financial reward when selling their home. But how do you

guarantee that you receive maximum value for your house? Here are two keys to

ensuring you get the highest price possible.

Every homeowner wants to make sure they

maximize their financial reward when selling their home. But how do you

guarantee that you receive maximum value for your house? Here are two keys to

ensuring you get the highest price possible.

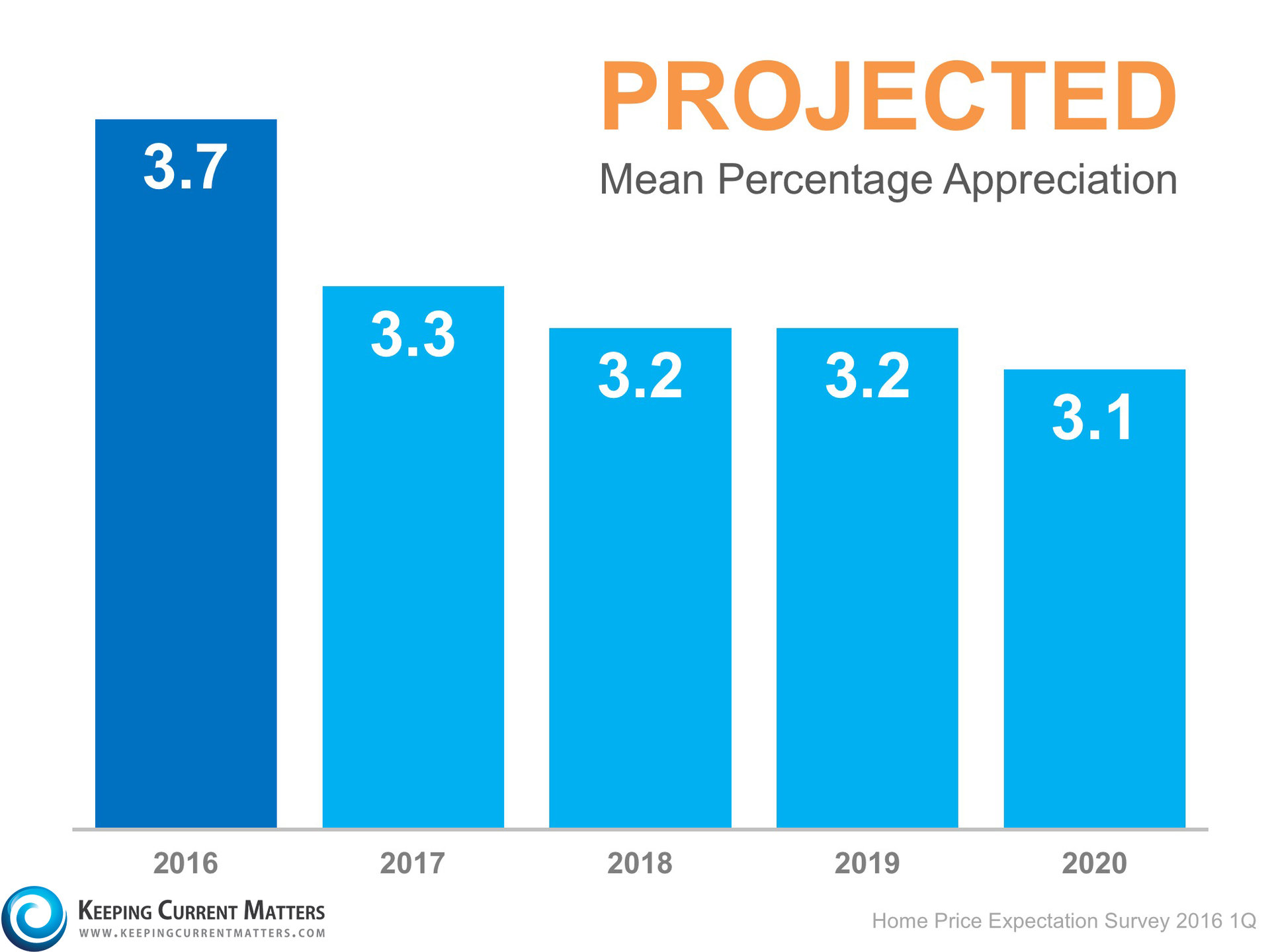

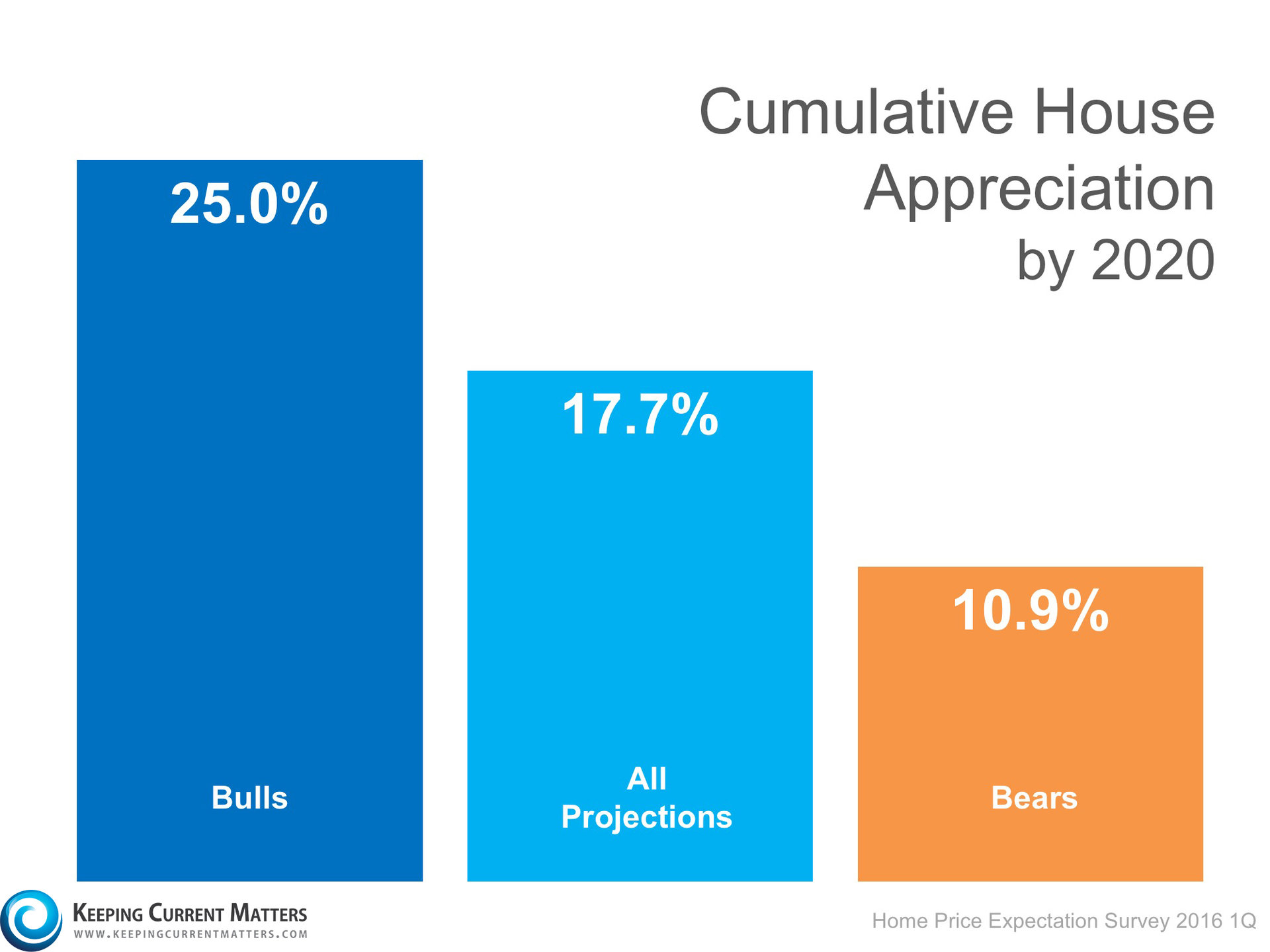

Today, many real estate conversations center

on housing prices and where they may be headed. That is why we like the

Today, many real estate conversations center

on housing prices and where they may be headed. That is why we like the

![The Difference an Hour Can Make [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/10/The-Difference-a-Hour-Makes.jpg)