Discover The North Fork …A

Quick Tour of The Area

Riverhead, gateway to both the North Fork and the Hamptons,

includes the towns of Baiting Hollow, Aquebogue and Jamesport,

and is home to some of the island’s best golf clubs, vineyards, and local farm

stands.

Handy

to the LIE, it is also boasts the 2,700-acre

Pine Barrens Preserve, the Atlantis Marine World Aquarium and the Tanger Outlet

Mall, a 165-plus store discount outlet.

Southold

has a rich heritage, dating back to 1640. It is New York’s oldest English

settlement and home to some of the best surviving examples of domestic English

architecture in the United States.

Amid acres of farmland and sandy beaches, well-kept historic

homes provide an idyll for those interested in the natural beauty of the

island. In 1973, the first winery on Long Island was established in Cutchogue.

The area is known for its vineyards and wine culture. Wineries

throughout the region are open year-round for tours and tastings.

From West to East, Southold includes the towns of: Laurel,

Mattituck, Cutchogue (New Suffolk and Nassau Point), Peconic, Southold, East

Marion and Orient.

Greenport,

a mariner’s dream, is a village unto itself, its streets lined with artsy

shops, galleries and fine restaurants. The North Ferry carries visitors and

locals across the Peconic Bay to Shelter Island.

Rates are low. Prices are at their winter lows, too. Come on out and let me help you find your North Fork Dream Home.

Call Your North Fork

Expert: Vicky Germaise 631.298.6146

+-+Copy.jpg)

Last week, I was talking to a young couple I know that was about to close on their first home. They were riding the wild rollercoaster of current mortgage rate swings and were not happy about the mortgage process overall. Yet, when the conversation shifted to finally living in a home that they own, their disposition changed dramatically.

Last week, I was talking to a young couple I know that was about to close on their first home. They were riding the wild rollercoaster of current mortgage rate swings and were not happy about the mortgage process overall. Yet, when the conversation shifted to finally living in a home that they own, their disposition changed dramatically.

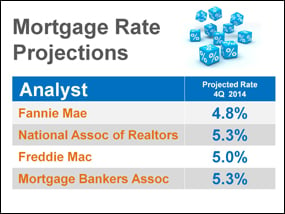

Last Monday, we reported that several analysts had upgraded their projections for home price appreciation in 2013. A few days later, the Wall Street Journal

Last Monday, we reported that several analysts had upgraded their projections for home price appreciation in 2013. A few days later, the Wall Street Journal